Personal Accident Insurance

BENEFITS

Accidental Death

When injury results in loss of life of the insured within twelve (12) months after the date of the accident, the insured will get the principal sum of Php50,000.00.

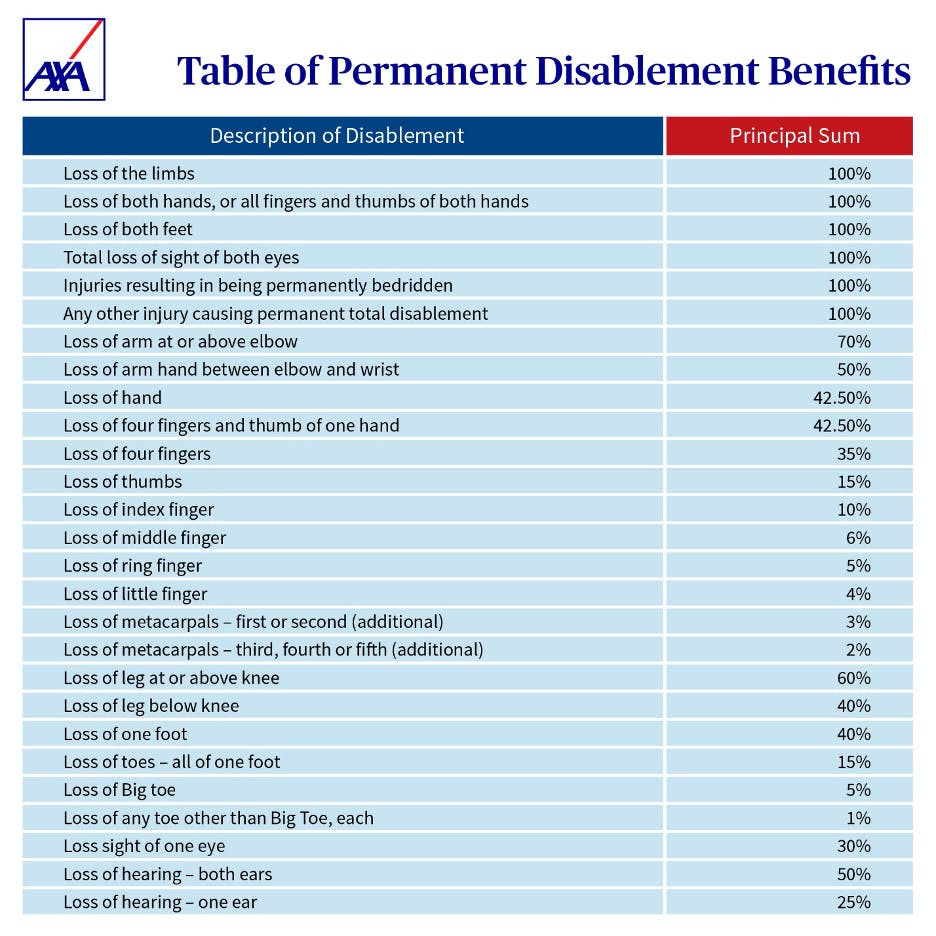

Permanent Disablement

When injury does not result in loss of life within twelve (12) months after the occurrence of the accident, but does result in any of the following losses, AXA will pay the equivalent as stated below:

CAMPAIGN MECHANICS

1. Any person can register up to two (2) cards at a given time. Any card issued in excess shall be considered null and void. In an unforeseen event, the Company shall not be liable for more than the applicable amount for any person per event.

GENERAL CONDITIONS

1. A written notice shall be given to the Company without unnecessary delay within 30 days in case of death from date of accident/injury.

2. Any person who is 18 to 70 years old during the policy period is eligible to register.

3. In the event of claim, all certificates, information and evidences required by the Company must be furnished at the expense of the Insured or his legal representatives, and shall be in such form and of such nature as the Company may prescribe. The Company shall, in case of death of the Insured, be entitled to have a post mortem examination at its own expense.

4. The Insured must give immediate notice in writing to the Company of any change in address, profession or occupation and the effecting of other insurances.

5. A written notice of claim given by or in behalf of the Insured or beneficiary to the Company or to any authorized representative of the Company, with information sufficient to the identity of the Insured shall be deemed to the notice of the Company.

6. Indemnity under this insurance is payable to the Beneficiary/ies indicated upon activation. In case of death or in the absence of a named beneficiary/ies, the Insured shall be deemed to have named the following as his/her beneficiary/ies in the order indicated and the proceeds under this policy shall be paid accordingly to the Insured’s:

a. Widow or widower, or

b. Surviving Children, or

c. Surviving Parents, or

d. Surviving Brothers and Sisters, or

e. Estate

7. No assignment of the benefits of this policy shall be binding upon the activation of coverage via the link sent to the Insured’s email. The Company does not assume any responsibility for the validity of the assignment. No change of beneficiary under this Policy shall bind the Company unless consent thereto is formally endorsed hereon by the Company.

8. This policy constitutes the entire insurance contract. Any rider, clause, warranty or endorsement purporting to be part of the contract of insurance and is pasted or attached to this policy is not binding to the Insured.

9. Completed claim forms and written proof of loss must be furnished to the Company within ninety (90) days after the death of the Insured. Failure to furnish such proof within the time required shall not invalidate nor reduce any claim. If it was not reasonably possible to give proof within such time, the same must be given as soon as it is reasonably possible.

10. The amount of loss for which the Company may be liable under this Policy shall be paid within thirty (30) days after proof of loss is received by the Company. Ascertainment is made either by agreement between the Insured and the Company or by arbitration; but if such ascertainment has not been made within sixty (60) days after such receipt by the Company of the proof of loss, then the loss or damage shall be paid within ninety (90) days after such receipt.

11. If a claim made was rejected and an action or suit be not commenced either in the Insurance Commission or any court of competent jurisdiction within twelve (12) months from receipt of notice of such rejection or in case of arbitration taking place as provided herein. Twelve (12) months after due notice of the award made by the arbitrator or arbitrators or umpire, the claim shall be, for all purposes, deemed to have been abandoned and shall not thereafter be recoverable here under.

EXCLUSIONS

This policy shall not extend to cover:

1. Death or disablement or bodily injury, occasioned by or happening through:

a. War, Terrorism, Invasion, Act of Foreign Enemy, Hostilities (whether war be declared or not), Civil War, Rebellion, Revolution, Insurrection, Mutiny, Military or Usurped Power, Riots, Strikes, Military or Popular Rising.

b. Suicide or Attempted Suicide (whether felonious or not, sane or insane), Hernia, Alcoholism, Intoxication, Drugs, Intentional Self-Injury, Insanity, Diseases or Infections (except pyogenic infections which shall occur through an accidental cut or wound).

c. Poison or poisonous any substances accidentally or otherwise taken, administered, absorbed or inhaled.

d. Earthquake, Volcanic Eruption, or Tidal Wave and other convulsions of nature.

2. Personal Accident decline risk per client’s activity:

a. Nuclear Power Plant, Nuclear Fuel Manufacturing, Radioactive Waste Storage, Nuclear Weapons;

b. Any type of controversial weapons-related insurance or reinsurance covers;

c. Coal Mining and coal-based energy production;

d. Tobacco Manufacturer;

e. Oils sands producer and oil sands-related pipelines;

f. Arctic oil drilling.

3. Death or disablement or bodily injury, occurring whilst the Insured is traveling in an aircraft other than one (1) licensed for public passenger service and operated by a regular Air Line on a published schedule flight over a regular air route between two (2) definitely established airports and in which the Insured is traveling as a ticket-holding passenger.

4. Death or disablement or bodily injury consequent upon the Insured engaging in any hazardous activities including but not limited to scuba diving, BASE (Building, Antenna, Span, Earth) jumping, hand gliding, race card driving, bungee jumping, parasailing, private aviation and off-roading or any sports that are played in a professional capacity or in competition involving prize, donations, sponsorship or reward of any kind, football, pigsticking, hunting, racing of all kinds, steeple chasing, polo playing, mountaineering, winter sports, boxing, ice hockey, football, yachting or using woodworking machinery driven by mechanical power, as a type of sport or hobby or for any other purposes.

5. Death or disablement or bodily injury occasioned by or happening through pregnancy or childbirth with respect to women.

6. Death or disablement or bodily injury, consequent upon the Insured engaging in the making or handling of explosives or upon being engaged as a custodian of explosives.

7. Death or disablement or bodily injury, consequent upon the Insured’s commission of or attempt to commit a felony as consequent upon the Insured’s being engaged in an illegal occupation or performing an unlawful act at the time of the loss.

8. Death or disablement or bodily injury consequent upon the Insured engaging in driving or riding a motorcycle, motor scooter, motor bicycle or any other two-wheeled motor vehicle, and/or with sidecar (three-wheeled).

9. Death or disablement or bodily injury, occasioned by or happening through shall not extend to cover the following risks:

a. Industrial workers using woodworking or heavy machinery (e.g. bulldozers, cranes, graders and the like);

b. Aircrew or non-fare paying aviation passenger (e.g. pilot, air stewardess);

c. Naval, military, police, or air force service personnel, including armed security guards;

d. Civil defense personnel (e.g. fire fighters) other than those in peace-time reservist training;

e. Construction workers / unskilled workers;

f. Ship crew or blue-collar workers on board vessels, stevedores, shipbreakers;

g. Occupations involving diving, or work at an oil and gas rig and/or onboard offshore vessel or platform (e.g. oil bunkering, kelong fishing);

h. Occupations involving working in the risky places high above the ground;

i. Occupations involving handling hazardous chemicals / electricity (e.g. electrician, welders);

j. Racing-related activities or organizations, such as professional sports teams;

k. Riders (driving two-wheeled motor vehicles);

l. Tricycle Drivers.

WAR AND TERRORISM EXCLUSION

Notwithstanding any provision to the contrary within this insurance or any endorsement hereto attached, it is agreed that this insurance excludes death, injury, illness, loss, damage, cost or expense of whatsoever nature directly or indirectly caused by, resulting from or in connection with any of the following regardless of any other cause or event contributing concurrently or in any other sequence to the loss;

- War, invasion, acts of foreign enemies, hostilities or warlike operations (whether war be declared or not), civil war, rebellion, revolution, insurrection, civil commotion assuming the proportions of or amounting to an uprising, military or usurped power; or

- Any act of terrorism

For the purpose of this endorsement, an act of terrorism means an act, including but not limited to the use of force or violence and/or the threat thereof, of any person of group(s) of persons, whether acting alone or on behalf of or in connection with any organization(s) or government(s), committed for political, religious, ideological or similar purposes including the intention to influence any government and/or to put the public, or any section of the public, in fear.

This endorsement also excludes death, injury, illness, loss, damage, cost or expense of whatsoever nature directly or indirectly caused by, resulting from or in connection with any action taken in controlling, preventing, suppressing or in any way relating to (1) and/or (2) above.

If the Insurer alleged that by reason of this exclusion, any loss, damage, cost or expense is not covered by this insurance the burden of proving the contrary shall be upon the Assured.

In the event any portion of this endorsement is found to be invalid or unenforceable, the remainder shall remain in full force and effect.

PAYMENT OF DOCUMENTARY STAMP TAX WARRANTY

It is hereby understood that upon the issuance of the policy, no Documentary Stamp Tax will be refunded as a result of the cancellation or endorsement of the policy or reduction in the premium due for whatever reason outside of the month of the issuance of the policy.

PERSONAL ACCIDENT POLICY

Click here to view the complete copy of the policy.

HOW TO MAKE A CLAIM

1. Download and fill out the Personal Accident claim form.

2. Submit the claim form along with the complete documentary requirements online to customer.service@axa.com.ph or to the nearest AXA branch.

3. Wait for confirmation if your request has been approved.

4. Receive the payout via you preferred channel.

CLAIM REQUIREMENTS

Accidental Death Claim

· Attending Physician Statement or Medical Certificate (original or Certified True Copy/CTC)

· Police Investigation Report and Statement of Witnesses (original or CTC)

· Birth Certificate (original or CTC) – insured/victim

· Death Certificate (NSO certified) – insured/victim

· Autopsy Report – if available (original or CTC)

· Marriage Contract (original or NSO certified)

· Two (2) Government Issued IDs

Permanent Disablement

· Personal Accident Claim Report Form – duly accomplished and signed

· Attending Physician Statement or Medical Certificate (original or CTC)

· Police Investigation Report and State of Witnesses (original or CTC)

· Birth Certificate (original or CTC)

· Official Receipts – for additional medical expenses (original copy)

· Hospital Records – for amputation and operation performed by attending physician

· Picture of Amputated/Affected Body Part/s of the Victim

· 7.1. Whole Body

· 7.2. Close shot of the affected body parts

· Two (2) Government Issued IDs